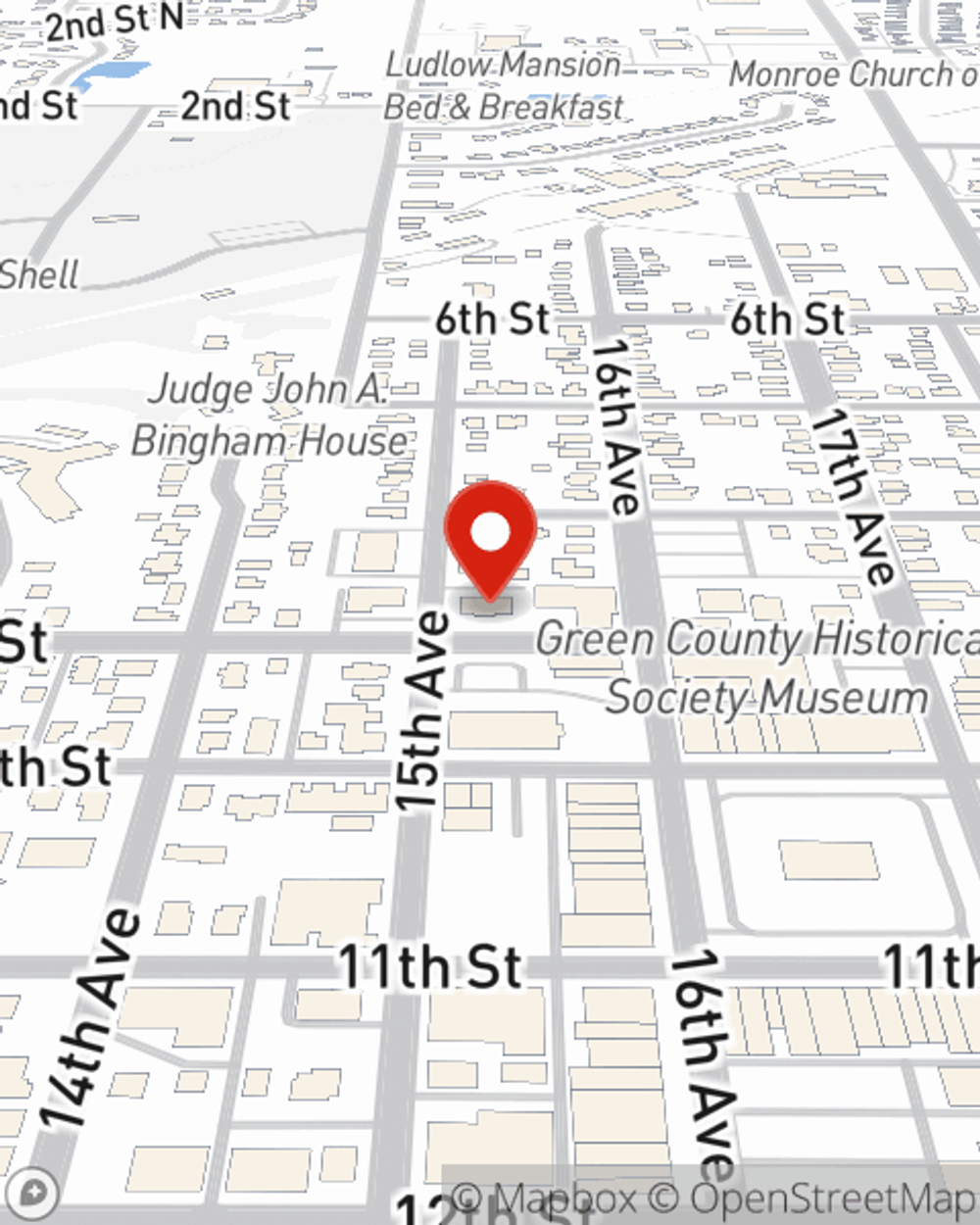

Business Insurance in and around Monroe

One of Monroe’s top choices for small business insurance.

No funny business here

Business Insurance At A Great Price!

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Mike Mancini is aware of the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to look into.

One of Monroe’s top choices for small business insurance.

No funny business here

Strictly Business With State Farm

If you're looking for a business policy that can help cover accounts receivable, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

It's time to contact State Farm agent Mike Mancini. You'll quickly discover why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Mike Mancini

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.